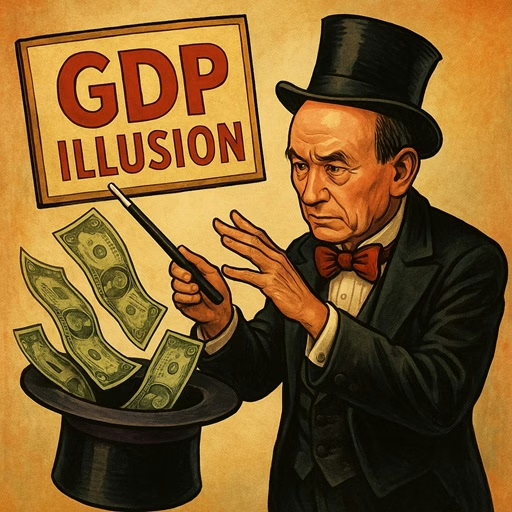

There’s a popular saying in China: “Officials produce the numbers, and the numbers produce the officials.” In no arena is this more true than with China’s GDP figures – those all-important, glossy statistics that proclaim the health of the nation’s economy. For years, China’s GDP growth has seemed almost magical, reliably hitting targets set by the government (6.9%, 6.5%, 6.0% – pick a number, and lo and behold, that’s the growth reported!). Critics have long joked that China’s GDP Illusion is “man-made”, not in the sense of human economic activity, but in the sense of human creative activity – as in, creative accounting. Even Li Keqiang, a former premier of China, once candidly admitted (in a leaked diplomatic cable) that GDP numbers in China are “man-made and therefore unreliable”. He famously preferred to gauge the economy using what came to be known as the Li Keqiang Index – a mix of electricity consumption, rail cargo volume, and bank loans – rather than trust the official GDP. When the country’s own top leaders don’t buy their stats, you know something’s fishy.

Welcome to the world of GDP manipulation – Chinese style. It’s a world where economic data is as much a product of political incentives as of market transactions. Let’s pull back the curtain on how and why China’s GDP numbers might be more illusion than reality, and what that means for the future.

Cooking the Books: How and Why it Happens

China’s economy is vast and complex, spread across 31 provinces, hundreds of cities, and thousands of counties. In theory, measuring GDP – the total value of all goods and services produced – is challenging for any large country. Add in the fact that Chinese local officials’ careers often depend on hitting growth targets, and you have a recipe for data fakery.

For decades, Beijing set annual GDP growth targets (say, “around 7%” for the year). These targets cascaded down like an imperial decree: provinces got their quotas (“grow 8%!”), then cities (“we need 9%!”), then counties. An official’s promotion prospects brightened if they met or exceeded the target – and dimmed if they fell short. The result? Strong incentive to inflate numbers. As one Chinese commentary put it, the system encouraged a game where officials would “produce numbers” to satisfy superiors, and in return the impressive numbers would “produce” promotions for the officials

Inflation of GDP can be done in various ways. A relatively benign way is by pushing through low-value projects that add to GDP in the short term. Think unnecessary highways to nowhere, extravagantly overbuilt public squares, or redundant factories – local governments might undertake them near year-end just to boost investment figures (a major component of GDP). This leaves a legacy of wasteful infrastructure and debt, but hey, it ticks the GDP box this year. A more egregious way is simply to fabricate data. Local statistics bureaus could report industrial output, retail sales, or investment figures higher than reality. For example, a province might claim a 10% increase in factory output while electricity usage (a more objective measure) stayed flat – a telltale sign something’s off. There have been infamous cases: in early 2017, Liaoning province admitted that from 2011 to 2014, it had faked its GDP growth numbers by about 20%. Shortly after, other regions like Inner Mongolia and Tianjin also confessed to economic data fraud, prompting Beijing’s embarrassment and action.

However, manipulation isn’t just a thing of the past. During the tumultuous pandemic years, many observers suspect the data was “smoothed.” When most major economies saw sharp contractions in 2020, China reported a positive +2.3% growth. Skeptics pointed out that consumer spending was likely hit harder than reflected, meaning the real figure might have been lower. But with a political narrative of triumph over COVID to uphold, a recession on paper was perhaps unacceptable. Data massaging – whether by tweaking deflators, under-reporting inflation (thus inflating real growth), or simply adjusting figures behind closed doors – remains a black box. Chinese statistics often show suspiciously low volatility (steady growth rates with minimal fluctuation), which former Fed chief Ben Bernanke politely noted could be due to over-smoothing by the NBS. In other words, the numbers look too perfect to be completely believed.

The Domino Effect of GDP Illusion: Risk of Believing Your Own Hype

Fudging GDP might seem consequence-free – after all, who gets hurt if a province says it grew 8% when it actually grew 6%? It’s just abstract numbers, right? Not exactly. There are real domino effects to sustained data manipulation.

First, policy missteps. If the central government is fed inflated numbers, it may underestimate problems. For example, if local GDP is overstated, Beijing might not realize how much stimulus is needed (thinking growth is fine when it isn’t) or might misallocate resources. In the late 2000s and 2010s, some analysts believe China’s leadership was caught off guard by how quickly excess capacity and debt piled up, partly because local data painted an overly rosy picture. Essentially, you can’t fix what you don’t accurately measure. There’s a saying: “Garbage in, garbage out.” Faulty data leads to flawed decisions. A dramatic instance was pointed out by a Yale study – it found that local officials tend to over-invest in projects with short-term GDP impact to meet target. That means bridges to nowhere and ghost cities got built to boost GDP figures, while more sustainable long-term investments (education, innovative industries) were neglected. The result? Local debts surged and economic efficiency suffered. If you spend 100 million yuan to boost GDP today but that asset yields no real future return, you’ve basically borrowed growth from the future for a sugar high now – and someday the bill comes due.

Second, loss of credibility. International investors and markets are not blind. They notice when data doesn’t pass the smell test. Although many still rely on China’s official numbers (because, what else is there?), a persistent skepticism means China likely pays a risk premium – for example, when foreign firms plan investments, they might be more cautious, or stock analysts discount valuations because of uncertain data quality. The Chinese leadership itself tacitly acknowledges credibility issues; Premier Li’s endorsement of alternative indicators was one sign. More recently, when the NBS suddenly stopped publishing certain data (like the aforementioned youth unemployment, or in 2023 they also stopped releasing consumer confidence indices for a while), it raised red flags among analysts. Imagine if the U.S. stopped releasing unemployment figures – people would panic or assume the worst. With China, the reaction was more like eye-rolling resignation: “Here they go again hiding bad news.” That erodes long-term confidence. If one day China needs global goodwill – say, widespread foreign buying of its government bonds to bail out a debt crisis – trust in its data will be crucial. Constant massaging of GDP undermines that trust.

Third, risk of internal complacency. Perhaps the most ironic danger is that Chinese officials might start believing their own cooked numbers. As one researcher quipped, local leaders who inflated figures now face a dilemma: if they ever report the real data, it will show a sharp drop (because their baseline was fake-high), which makes them look terrible and which in turn encourages a cycle of continuing the lie. But it can also breed complacency – a sense of “our region is doing great” when in fact it isn’t. There’s anecdotal evidence that some failing projects were kept on life support purely to not generate bad economic stats that would embarrass bosses. That means a delay in acknowledging and addressing problems until they hit crisis levels. Think of bad loans in banks or insolvent state enterprises – if authorities fiddle with reporting, these problems can grow unchecked like a cancer. When reality finally bites (you can’t fake cash forever, only paper figures), the reckoning is much larger.

Unmasking the Numbers: Signs to Watch because of GDP Illusion

For those trying to read China’s economy, there are a few tricks beyond trusting the headline GDP. Analysts often watch proxy indicators:

- Electricity consumption: Harder to fake, closely tied to industrial activity. A big divergence between power usage growth and GDP growth is a red flag. (Indeed, Li Keqiang loved this metrics).

- Rail freight volume: Similarly, if goods are being produced and sold, they must be transported. A slump in freight with no GDP slump? Suspect.

- Imports/Exports (in partner data): China reports its own trade data, but trading partners also report theirs. If China says exports are booming but the rest of the world’s import data doesn’t match, something’s off.

- Tax revenues: Local governments reporting high GDP but strangely low tax collection could indicate creative accounting.

- Night-time lights: Yup, economists have even used satellite imagery of night lights as a proxy for economic activity. Studies have found discrepancies between China’s reported growth and what the luminosity data suggests, particularly at the local level. Night lights don’t lie (unless everyone’s sitting in the dark).

To Beijing’s credit, it knows it has a data problem. The central government has repeatedly punished officials caught faking stats (sometimes as part of the anti-corruption campaign). They’ve also moved to streamline statistical reporting, making it more independent of local interference. For example, some surveys are now directly conducted by national authorities rather than going through local officials. China even did a data revision in 2020 after a nationwide economic census, which added some honesty to the figures (services output was revised, and some provinces had their GDP recalibrated). Still, old habits die hard, especially in a system where bad news is not welcomed.

Interestingly, China’s 2023 and 2024 growth came in lower than targets (e.g. they targeted ~5.5% for 2022 but got ~3% due to lockdowns; in 2023 targeted ~5% and may have been slightly under). Some see this as a sign that the government didn’t fudge too much and accepted the lower outcome – or conversely, that even the almighty CCP couldn’t fake it beyond a point without losing all credibility. Others suspect that while the direction of growth (up or down) is usually right, the amplitude might be smoothed. For instance, 2022’s 3% contraction could have been worse, and 2021’s 8.1% rebound could have been overstated to compensate – who knows?

Why It Matters: The Future and India’s Stake

In the grand scheme, does it really matter if China grew 4% versus 6% one year? Perhaps not to the average person outside China. But the practice of data manipulation speaks to governance quality. A country confident in its trajectory has no need to cook numbers; doing so signals insecurity or short-termism. If China’s economy faces serious headwinds (debt, aging, etc.), unreliable data could mean it hits a wall at full speed, because the warning gauges were tampered with.

For India, and others, transparency can be a competitive advantage. Investors fed up with opaque data in China may prefer India if it maintains robust statistical systems (India has had its own GDP data controversies in recent years, so it’s not immune, but there’s an open debate and methodology scrutiny which is healthy). As global supply chains reorient, having trustworthy data can attract companies who want predictability.

Moreover, global institutions (IMF, World Bank, etc.) rely on Chinese data for their world economic outlooks. If China is overstating growth, the whole world’s growth is slightly overstated (since China is such a big chunk). That affects everything from commodity price expectations to climate change models (emissions relate to economic output).

There’s also a strategic element: some analysts worry that if China’s economy is weaker than it appears, the Chinese leadership might become more erratic or aggressive internationally to rally domestic support (a weaker economy could threaten the social contract at home, wherein the CCP justifies its rule by delivering growth). This is speculative, but not impossible. Conversely, if the world thinks China is stronger (due to inflated GDP) than it actually is, it might accord Beijing more clout or fear than warranted. So peeling back the illusion to see the real strength is key for realistic geopolitics.

In sum, China’s GDP numbers sometimes seem like a hall of mirrors – reflecting something real, but distorted. The government is both the magician and the audience in this show, conjuring impressive figures and hoping everyone claps. But as any magician knows, if the trick is revealed, the awe turns to disappointment. China’s challenge ahead will be to transition from an economy driven by “growth at any cost” to one of high-quality, transparent growth. That means valuing accuracy over appearance. There are signs this is slowly happening – the very admission of past data problems and moves to centralize stats are positive. However, as long as political careers hinge on economic performance, the temptation to pad the resume will be strong.

For now, when you hear that China’s GDP grew X%, remember to add an asterisk in your mind. The true number might be a bit lower (or in rare cases higher) – but more importantly, consider the context behind that figure. Look at other clues and read between the lines of official reports. Often, you’ll find a more nuanced story than a single percentage can convey. And ultimately, that nuanced reality is what matters – because you can’t forever run an economy on make-believe. Eventually, the rubber meets the road, the real productivity (or lack thereof) shows up, and the bills come due.

As the old saying (attributed to Abe Lincoln) goes, you can’t fool all the people all the time. For China’s economic data apparatus, the goal should be to stop fooling itself. Only then can the picture in the mirror be trusted – by China, by its citizens, and by the world.

Also Read: XI Jinping Economic Unrest: The Hidden Crisis behind China’s Calm